Livestock Risk Protection Study

The Livestock Risk Protection (LRP) Study was created for you to better understand how LRP can work for your operation.

Livestock Risk Protection (LRP) is a single-peril insurance program of the USDA Risk Management Agency (RMA). Created in 2002, this program protects against price risk in livestock operations. As a single-peril insurance, it does not protect against any risk (i.e., mortality, disease, disaster) other than price decrease. This insurance is currently available for feeder cattle, fed cattle, swine, and lambs (Livestock Risk Protection Feeder Cattle Fact Sheet, 2021). This study focuses on LRP for Feeder Cattle. While this insurance product has been available since 2002, recent increases in premium subsidies have made it more attractive for cattle producers. It is important to note, however, that subsidization of the premium is only available for producers who are conservation compliant according to USDA Farm Service Agency (FSA) standards. More information on conservation compliance is available from FSA (https://www.fsa.usda.gov/programs-and-services/payment-eligibility/conservation_compliance/index). Any person who owns livestock or a share in livestock may purchase LRP coverage endorsement through an RMA approved agent (https://prodwebnlb.rma.usda.gov/apps/AgentLocator/#/).To purchase an endorsement a producer would need to go to an approved agent and start by filling out an application, which is a one-time form. Once this application is approved, the producer would be eligible to purchase an endorsement (Griffith 2021).

Table 1 LRP-Feeder Cattle Endorsement Types

Number of Head |

Length (weeks) |

Cattle Type |

Weight |

Up to 6,000 per endorsement, 12,000 per producer per year |

13, 17, 21, 26, 30, 34, 39, 43, 47, 52

|

Calves; Steers; Heifers; Predominantly Brahman cattle; Predominantly dairy cattle; Unborn calves.

|

Light (Type 1) <600 lbs Heavy (Type 2) 600-900 lbs |

Source: (Griffith 2021)

Table 1 shows various types of LRP-Feeder Cattle endorsement coverage options currently available for cattle producers. The appropriate endorsement would be determined by the number of head needing to be insured, the time period until marketing of the cattle, the cattle type, and their weight. For example, on January 15 in any given year, a producer with 30 steers that are projected to weigh 650 lbs and be sold in about 5 months would purchase a 21-week endorsement for the steers cattle type, and the heavy (Type 2) weight type.

The coverage, or protection, that is provided by the endorsement and the price of that protection is related to the expected ending value (EEV) and the premium. The EEV is tied to the price of the Chicago Mercantile Exchange (CME) feeder cattle (FC) futures contract maturing near (but not before) the end of the endorsement period (Griffith 2021). In the above example, the EEV is very close to the price of the August FC futures contract on the date the endorsement is purchased. The coverage price level, which is the price that is insured, represents a percentage of the EEV. For example, if the August FC futures price is $150/cwt and the coverage level is 97%, then the coverage price level is approximately $145.50/cwt. As with any type of insurance, the higher the coverage level, the higher the cost of the insurance (premium). However, it is important to remember that these premiums are subsidized.

Table 2 Subsidy Rates

Coverage Level (%) |

Subsidy Rate (%) |

95.00-100.00 |

35 |

90.00-94.99 |

40 |

85.00-89.99 |

45 |

80.00-94.99 |

50 |

70.00-79.99 |

55 |

Source: (Griffith 2021)

Table 2 shows the share of the premium that RMA will subsidize based on the selected coverage level. Recent increases in subsidization have made the program more cost effective. For example, if a producer selects a 97% coverage price level, then RMA will subsidize 35% of the premium cost.

The premium cost rate is set by RMA based on the endorsement type and coverage level. It is approximately the same cost as a put option in the feeder cattle futures market (Burdine 2022). The producer premium cost per hundredweight can be found at this link: https://public.rma.usda.gov/livestockreports/main.aspx. It is calculated based on the EEV (i.e., $150/cwt) and the coverage level (70-100%), which is used to determine the subsidy rate. In general, the premium cost is reduced as the percent coverage level and length of coverage decreases. This is because lower coverage levels carry decreased premiums and increased subsidies. A lower coverage level does reduce the chance of an indemnity payment, however, as a more substantial price drop would have to occur for the endorsement to payout.

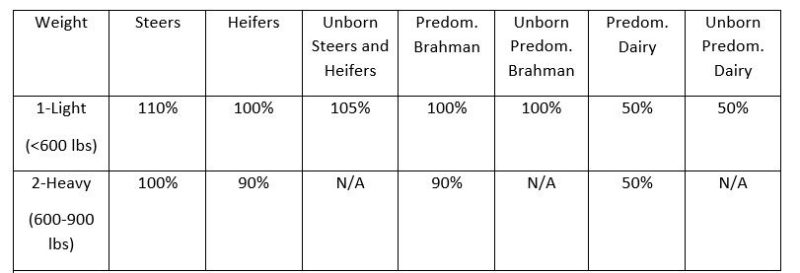

Whether or not an indemnity payment is made is based on the actual ending value (AEV). The AEV is the CME Feeder Cattle Index (FCI) price averaged across the five trading days preceding the day the endorsement ends multiplied by the LRP-Feeder Cattle Price Adjustment Factor shown in Table 3. This is determined on the day the endorsement ends, as specified by the length of the endorsement, (i.e., 21 weeks, 26 weeks, etc.) The CME FCI is a cash price index of feeder cattle prices across 12 states in the Midwest. From the example above, once the 21-week endorsement period is completed, the CME FCI value would be multiplied by 110%, because light weight steers were insured. This value would be averaged across the four preceding trading days and the day the endorsement ends. This calculation (performed by RMA) gives the AEV for the endorsement. For more information on the CME FCI and how it is calculated see the Settlement Procedures section of the CME Rulebook at this link: https://public.rma.usda.gov/livestockreports/main.aspx.

Table 3 Livestock Risk Protection Feeder Cattle Price Adjustment Factors

Source: (Griffith 2021)

Once the endorsement period ends, the AEV multiplied by the adjustment factor, 110% in this case, is used to determine if an indemnity payment is made. If the CME FCI after the 21 weeks has expired is $150/cwt, then no indemnity payment is made. If it falls below the 97% coverage level of $145.50/cwt, then an indemnity payment would be made. If an indemnity payment is warranted, the insurance underwriter will notify the agent and the producer, and once the producer verifies ownership of the cattle, they will be issued a settlement check from the underwriting agency.

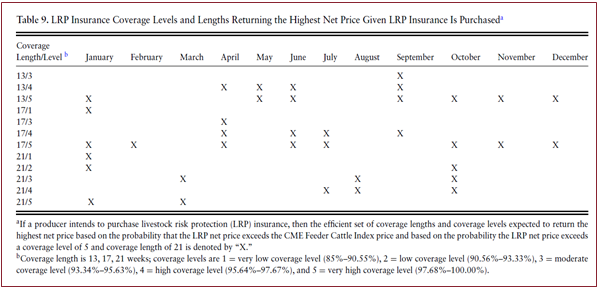

Deciding the appropriate level of coverage to ensure the optimum level of risk protection represents another challenge. While an RMA certified insurance agent will ultimately be the most helpful in determining the appropriate level of coverage, research from the University of Tennessee-Knoxville addresses this question. These researchers looked at daily LRP data from Tennessee cattle producers for heavy (600-900 lbs) cattle from July 2007-August 2016 (Merritt et al. 2017). They developed an economic and econometric model to determine what LRP coverage level was most likely to payout. A noteworthy aspect of their research is that policies with coverage levels under 85% were omitted because these were less than 4% of the observations they had and less than 0.6% of endorsements that received an indemnity payment. Also, they excluded coverage lengths that were greater than 21 weeks, as that was only 1.7% of the total policies. While different producers may have different needs, this provides an avenue of simplification, by narrowing down the myriad of policy options available to producers. The exclusion of certain coverage lengths and levels can help Virginia cow/calf producers narrow down their options. Tennessee and Virginia have many similarities in size of their average cattle operations (2017 Census of Agriculture). 88.4% of Tennessee and 83.4% of Virginia cattle farms have less than 100 head (2017 Census of Agriculture). The researchers distilled their study to coverage lengths of 13, 17, and 21 weeks and coverage levels of 85% or greater. Their goal was to determine if there was a coverage length, level and timing of endorsement purchase that increased the likelihood of an indemnity payment.

Figure 1 is designed to show what length and coverage level is the most likely to payout based on the University of Tennessee research. For example, April-13/4 is marked with an “X”. This indicates that if a producer purchases an endorsement 13 weeks in advance of April marketing of feeder cattle (i.e., purchase in December) with a coverage level of 95.64% - 97.67% (see coverage level categories at bottom of graphic), then it is more likely that the LRP net price will exceed the CME Feeder Cattle Index price than for a 21-week endorsement with a coverage level of 97.68%-100.00%.

Figure 1 Best time and type for LRP purchase (Merritt et al., 2017)

Table 4 LRP Net Return

LRP Net Return Outcome $138/cwt coverage level, -$6 Basis, 6.5 cwt steer, $850 breakeven |

||||

LRP AEV |

Local Cash Price |

Premium |

Indemnity |

Return per head |

$151/cwt |

$145/cwt |

$3.56/cwt |

$0/cwt |

$92.50 |

$141/cwt |

$135/cwt |

$3.56/cwt |

$0/cwt |

$27.50 |

$131/cwt |

$125/cwt |

$3.56/cwt |

$7/cwt |

$8.00 |

$121/cwt |

$115/cwt |

$3.56/cwt |

$17/cwt |

$8.00 |

Source: (Burdine 2022)

Table 4 shows a variety of price scenarios and their associated net return outcomes. Please note that the LRP AEV and Local Cash prices have been rounded for simplification. The breakeven price of $850 is based on generic costs on a per head basis of a cow/calf operation with 50 head (Munns et al. 2016) For the purpose of this example, the premium cost of $3.56/cwt is included in the breakeven figure. Breakeven costs will vary substantially from operation to operation. The column on the far right shows some noteworthy results. When the local price is the highest, there is the highest return. When prices drop by $10/cwt to $135/cwt however, there is a puzzling scenario. The coverage level that was purchased is $138/cwt. This is intended to put a floor under the expected price for the cattle. In this scenario however, basis risk comes into play. Basis is the difference between the local cash market price and the futures, or in this case the CME Feeder Cattle Index price. This is what the Actual Ending Value (AEV) for LRP is based upon. What this means is, although the coverage level of $138/cwt was selected and the Local Cash Price was lower than that ($135/cwt), because the LRP AEV is still higher than the coverage level ($141/cwt), no indemnity payment is made. This is simply a risk that LRP does not cover because it is indemnified on an index and not the local cash market. It is important to note that as the price falls in the next two scenarios, the return per head remains the same. This is the intention of the insurance, to create a price floor which protects against catastrophic loss. It is ultimately better for the insurance not to pay out however, and instead for the market to remain strong.

The illustrations described in this section demonstrate an application of an LRP policy to a typical cow/calf farm in Virginia. All LRP prices are taken from https://rma.usda.gov/Information-Tools/Livestock-Reports and the Lynchburg Livestock Market cash prices are taken from the USDA Agricultural Marketing Service report for 7/19/2021 (https://mymarketnews.ams.usda.gov/filerepo/sites/default/files/2184/2021-07-19/482439/ams_2184_00107.pdf). Timelines and production schedules have been based on general production practices of Virginia cow/calf operations. This example is not intended to provide individual business or insurance guidance as needs and best practices vary significantly across operations.

For example, a fall calving producer has 35 brood cows that give birth to 17 heifers and 17 steers, while one calf did not survive. The producer decides to retain 7 heifers to raise as replacements for their herd or to be sold and 2 steers to raise to slaughter weight for freezer beef. This results in 10 heifers and 15 steers being kept to raise as feeder cattle. The calves are born across a ~45-day time period from September 15th to October 30th in 2020. The producer plans to sell the calves at an average weight of 650 lbs for the steers and 600 lbs for the heifers in about 9 months, which would be mid-July of 2021. After a few months of the calves growing and beginning to fill out, the producer decides that there is a lot of uncertainty surrounding the cattle market. So, on 1/14/2021 they visit their crop insurance agent to purchase two LRP-Feeder Cattle endorsements. They are both 26-week endorsements ending 7/15/2021 at the 96.16% coverage level. One endorsement is for the 15 steers which will be heavy weight, type 2 (600-900 lbs) at the time of marketing and one for the 10 heifers which are also expected to be heavy weight, type 2 (600-900 lbs). On 1/14/21, the closing August FC futures price was $145.53/cwt. Through RMA’s calculations this sets the EEV on 1/14/2021 at $143.96/cwt with a total unsubsidized premium cost of $5.47/cwt for steers and $4.93/cwt for heifers. For the steers the coverage price was $138.43/cwt (EEV x coverage level), for the heifers the coverage price (EEV x coverage level) was $124.59/cwt.

With a 35% subsidy, the steers’ premium price was $3.56/cwt, resulting in a total cost of $347.10 or $23.14/head for the endorsement for the 15 steers ($3.56/cwt x 6.5 cwt/steer x 15 steers). The heifers’ premium price was $3.20/cwt based on a 35% subsidy. This gives a total cost of $192.00 or $19.20/head for the endorsement for the 10 heifers ($3.20 cwt x 6 cwt/heifer x 10 heifers). Thus, the LRP had a total premium cost of $539.10 in this case. This results in a price floor of $134.87/cwt for the steers and $121.39/cwt for the heifers for this cattle producer, after subtracting the cost of the premium from the coverage price.

Once the cattle were ready for market, the producer sold these cattle at the Lynchburg Livestock Market in Rustburg, Virginia at the July 19, 2021, state graded feeder cattle sale. The average price for Medium and Large 1 steers at an average weight of 643 lbs was $145.42/cwt. Medium and Large 1 heifers with an average weight of 631 lbs brought $125.62/cwt.

From the above example, the AEV for the LRP policy was $151.39/cwt for the steers and $135.25/cwt for the heifers. In both cases the coverage price level of the endorsement ($138.43/cwt steers, $124.29/cwt heifers) was below the cash prices at Lynchburg as well as AEV. This is an important comparison because LRP indemnity payments are only made when the AEV falls below the coverage price of the policy, not when the cash price actually received does. This means that in certain cases the difference between the cash price and AEV of the CME FCI can hurt a producer where they receive less than their coverage price level at the cash market, but don’t receive an indemnity payment and are out the cost of the premium.

In the above example the insurance did not pay out. It cost the producer $539.10 and then they marketed the cattle in Lynchburg in the same month that the endorsement expired and were finished. It is worth noting that producers do not have to market the cattle at the expiration of the endorsement. If the AEV is above the coverage price level, then the producer simply pays the premium. If the AEV is below the coverage price level then the producer will receive an indemnity payment but is still not obligated to sell the cattle in the cash market. It is however best to market the cattle at or as close as possible to the expiration of the endorsement to ensure that additional risk is not taken by paying the premium for the insurance, and then prices dropping, and further losses being incurred without an indemnity payout.

In order to demonstrate specifically the payout scenarios as shown in Table 4, we can look at the same format as the previous example but turn the clock back to 2019. In this example the Lynchburg Livestock Market cash prices are taken from the USDA Agricultural Marketing Service report from 7/14/2020 (https://mymarketnews.ams.usda.gov/filerepo/sites/default/files/2184/2020-07-13/298184/ams_2184_00056.pdf). The same fall calving producer has 10 heifers and 15 steers being kept to raise as feeder cattle. The calves are born across a ~45-day time period from September 15th to October 30th in 2019. The producer plans to sell the calves at an average weight of 650 lbs for the steers and 600 lbs for the heifers in about 9 months, which would be mid-July of 2020. So, on 1/14/2020 they visit their crop insurance agent to purchase two LRP-Feeder Cattle endorsements. They are both 26-week endorsements ending 7/14/2020 at the 96.5% coverage level. One endorsement is for the 15 steers which will be heavy weight, type 2 (600-900lbs) at the time of marketing and one for the 10 heifers which are also expected to be heavy weight, type 2 (600-900 lbs). On 1/14/20, RMA’s EEV was $154.32/cwt with subsidized premiums of $3.61/cwt for steers and $3.25/cwt for heifers. For the steers the coverage price was $148.92/cwt (EEV x coverage level), for the heifers the coverage price (EEV x coverage level) was $134.03/cwt. This gives a total cost of $351.98 or $23.47/head for the endorsement for the 15 steers ($3.61/cwt x 6.5 cwt/steer x 15 steers). And a total cost of $195.00 or $19.50/head for the endorsement for the 10 heifers ($3.25 cwt x 6 cwt/heifer x 10 heifers). Thus, the LRP had a total premium cost of $546.98 in this case.

Once the cattle were ready for market, the producer sold these cattle at the Lynchburg Livestock Market in Rustburg, Virginia at the July 13, 2020, state graded feeder cattle sale. The average price for Medium and Large 1 steers at an average weight of 645 lbs was $137.83/cwt. Medium and Large 1 heifers with an average weight of 636 lbs brought $113.75/cwt.

On 7/14/2020, the AEV for the LRP policy was $135.91/cwt for the steers and $122.32/cwt for the heifers. This is significantly below the coverage prices of $148.92/cwt (steers) and $134.03/cwt (heifers). As the AEV was below the coverage price for both steers and heifers, this producer would have received a payout for the difference between the coverage price and the AEV. This would amount to $13.01/cwt for the steers ($148.92-$135.91) and $11.71/cwt for the heifers ($134.03-$122.32). This means that the producer would be due an indemnity payment of $1,971.08, which would result in a net gain of $1,424.10 after taking out the cost of the premium.

The national and Virginia cattle markets saw substantial declines during the summer of 2020 as a result of a glut of cattle on feed resulting from processors working under capacity due to COVID-19 concerns. In the two examples above, the producer paid an almost identical amount on the premiums both times but saw very different results from that investment. In 2020, the producer gained $1,424.10 from having LRP; in 2021, the producer “lost” $539.10 from having the policy. This should offer insight into how LRP should be viewed. Similar to automotive insurance, it is a cost of doing business that can help mitigate catastrophic loss.

The above description is designed to be a concise and practical explanation of the design and use of LRP. This study addresses the fact that often Virginia producers do not choose to utilize LRP as a risk management strategy. The reasons for this are varied. There is perhaps a lack of education regarding the program and its benefits, as well as perhaps a broader belief that risk management is not necessary or cost effective. It is critical to note that the question is not whether small Virginia cow/calf producers can afford to manage price risk, it is whether they can afford not to.

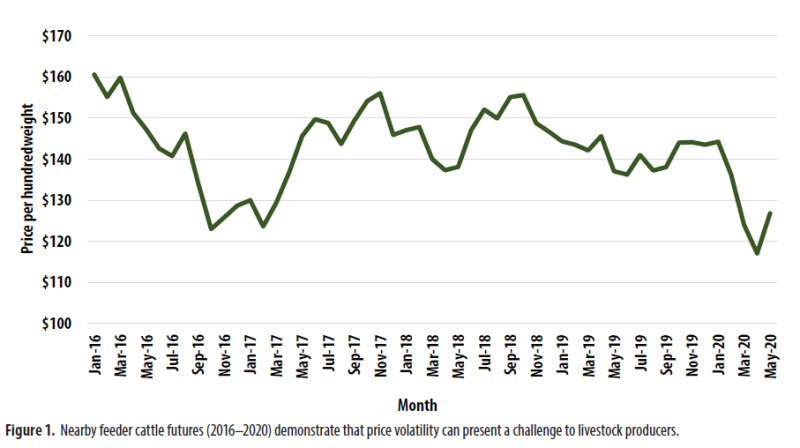

Figure 1 Nearby cattle futures price volatility (Bock et al. 2020)

Figure 1 demonstrates some of the price volatility in feeder calf prices that necessitates a risk management strategy. In the 2016-2020 period alone, nearby cattle futures saw a $40/cwt price range (Bock et al., 2020). This could translate into over ~$250/head price swings. Which, assuming all other costs are held constant (which they are not), the difference between marketing a group of 30 feeder cattle in March of 2016 (greater than $160/cwt) and March of 2020 (less than $120/cwt) could be over $7,500. This puts some context around the above example’s $539.10 total premium cost for an endorsement. A large price swing could be the difference between profit or loss for an operation and for small operations could mean an end to business viability. Using LRP allows cattle farmers to set a price floor for their output and thus stabilize their income.

The findings of Merritt et al. (2017) show that while LRP can be useful across the board, specific producers may need it more than others. For instance, those who are carrying heavy debt loads or need extended credit may find it useful to increase a lender’s willingness to lend to them (Merritt et al., 2017). This is especially true for small producers who may not have substantial cash reserves or for lenders who are uncomfortable or unfamiliar with futures market-based risk management. LRP is not an end all be all solution, but it does help small producers who may not have access to futures and options be able to insure against catastrophic price shocks.

Despite the risks of cattle farming, some of which are heightened in an increasingly consolidated marketplace, in 2015, only 7% of beef cattle producers across the U.S. were using LRP to manage price risk (Merritt et al., 2017). As it relates to the average Virginia cow/calf producer, LRP has many advantages. A producer can insure any number of cattle up to 6,000 per endorsement and 12,000 per producer. Recently, RMA has significantly increased the level of premium subsidization over pre-pandemic levels, making an LRP policy less expensive. With these new subsidy levels, LRP premiums are less expensive than a put option in the futures market in all months (Dennis 2021). The increased subsidy of LRP premiums also means that there is potentially more flexibility when it comes to choosing a coverage level and endorsement length than what was determined by Merritt et al. (2017).

There are also multiple insurance agencies in Virginia who are certified brokers of these endorsements as well, meaning that expertise and servicing is highly available. Another advantage that LRP carries over futures and options is that there are no margin calls. This is a great advantage for small producers so that they do not have to continue extending credit with a lender or tying up cash in a brokerage account. While there are perhaps many ways of explaining the value and importance of managing price risk in a cattle operation, the basic concept is the same as any other insurance. Although the barn may not have burned down this year, that is not reason enough to cancel the insurance policy on it.

Bock, Bryce, Massey, Ray and Milhollin, Ryan. “Livestock Risk Protection (LRP) Insurance” October 2020. University of Missouri Extension. https://extension.missouri.edu/publications/g459. Accessed February 7, 2022.

Burdine, Kenny. “Understanding Livestock Risk Protection (LRP) Insurance” Lecture, Zoom, February 24, 2022. University of Kentucky Cooperative Extension Service.

Dennis, Elliott. “Federal Livestock Insurance Market Performance and Use in Nebraska” January 2021. University of Nebraska - Lincoln, Department of Agricultural Economics. https://farm.unl.edu/livestock/federal-livestock-insurance-market-performance-and-use-nebraska/02082021-1214. Accessed February 16, 2022.

Griffith, Andrew P. “Livestock Risk Protection Insurance (LRP): How It Works for Feeder Cattle.” May 2021. University of Tennessee Institute of Agriculture. https://extension.tennessee.edu/publications/Documents/W312.pdf. Accessed January 28, 2022.

“Livestock Risk Protection Feeder Cattle Fact Sheet.” January 2021. United States Department of Agriculture Risk Management Agency. https://www.rma.usda.gov/en/Fact-Sheets/National-Fact-Sheets/Livestock-Risk-Protection-Feeder-Cattle. Accessed January 28, 2022.

“Lynchburg Graded Feeder Cattle Sale - Rustburg, VA.” July 19, 2021. AMS Livestock, Poultry, & Grain Market News, Virginia Dept of Ag Market News. https://mymarketnews.ams.usda.gov/filerepo/sites/default/files/2184/2021-07-19/482439/ams_2184_00107.pdf. Accessed February 11, 2022.

“Lynchburg Graded Feeder Cattle Sale - Rustburg, VA.” July 13, 2020. AMS Livestock, Poultry, & Grain Market News, Virginia Dept of Ag Market News.

https://mymarketnews.ams.usda.gov/filerepo/sites/default/files/2184/2020-07-13/298184/ams_2184_00056.pdf Accessed April 4, 2022.

Merritt, Meagan G., Griffith, Andrew P., Boyer, Christopher N. and Lewis, Karen E.. “Probability of Receiving An Indemnity Payment from Feeder Cattle Livestock Risk Protection Insurance”. August 2017, Journal of Agricultural and Applied Economics.

Munns, Anna L., Fulton, Joan, Widmar, Nicole O.. “Small-Scale Livestock Enterprises: Cow-Calf Enterprise Budget”. January 2016. Purdue Extension.

2017 Census of Agriculture – Virginia. https://www.nass.usda.gov/Publications/AgCensus/2017/Full_Report/Volume_1,_Chapter_1_State_Level/Virginia/st51_1_0013_0014.pdf. Accessed December 29, 2021.

2017 Census of Agriculture - Tennessee. https://www.nass.usda.gov/Publications/AgCensus/2017/Full_Report/Volume_1,_Chapter_1_State_Level/Tennessee/st47_1_0013_0014.pdf. Accessed February 10, 2022

RMA LRP Agent Locator:

https://rma.usda.gov/Information-Tools/Agent-Locator-Page

Daily LRP Coverage Prices, Rates, and Actual Ending

Values: rma.usda.gov/Information-Tools/Livestock-Reports

Premium Calculator:

ewebapp.rma.usda.gov/apps/costestimator/

Related AMS online livestock reports: https://mymarketnews.ams.usda.gov/filerepo/reports